Understanding Asset Backed Digital Currencies (ABDCs): The Future of Finance

ABDCs represent a revolutionary form of investment. They uniquely combine the stability of tangible assets with the flexibility of digital currencies. So, let’s delve into what exactly asset-backed digital currencies (ABDCs) are and uncover how they work.

What are ABDCs?

ABDCs are digital currencies that are backed by tangible assets. For example, these assets can range from precious metals like gold and silver to real estate or intellectual property. Because the value of an ABDC is tied to the value of its underlying asset, it provides stability and reliability in the often volatile world of digital currencies.

Why Choose ABDCs?

The value of an ABDC directly links to the value of its underlying asset. Consequently, this connection provides stability and reliability in the often volatile world of digital currencies. Here are a few reasons why ABDCs are becoming a popular choice for investors:

- Stability: ABDCs are less volatile and not prone to dramatic price fluctuations compared to conventional cryptocurrencies.

- Reliability: Each token of a commodity-backed cryptocurrency corresponds to a real unit of physical precious metal, usually stored by banks or third-party custodians.

- Flexibility: ABDCs combine the stability of gold, silver or other precious metals with the convenience of digital currencies.

This makes ABDCs an exciting form of investment. They combine the stability of gold, silver or other precious metals with the flexibility and convenience of digital currencies. Each token of a commodity-backed cryptocurrency corresponds to a real unit of physical precious metal, usually stored by banks or third-party custodians. In other words, this makes them less volatile and not prone to dramatic price fluctuations compared to conventional cryptocurrencies.

Why ABDCs Matter

ABDCs are a significant innovation in the realm of sound money because they combine the benefits of digital currencies, such as ease of transfer and global accessibility, with the stability and reliability of sound money. In short, this combination makes ABDCs an attractive option for those seeking a digital currency that offers both convenience and stability.

Asset Backed Digital Currency Providers

Several gold, silver, and other commodity-backed digital currencies have gained popularity among investors.

Some of these services have affiliate links that help to support Citizens 4 Sound Money. Where applicable, you will see the affiliate link at the bottom of the supplier’s description.

Kinesis (KAU, KAG)

kinesis.money

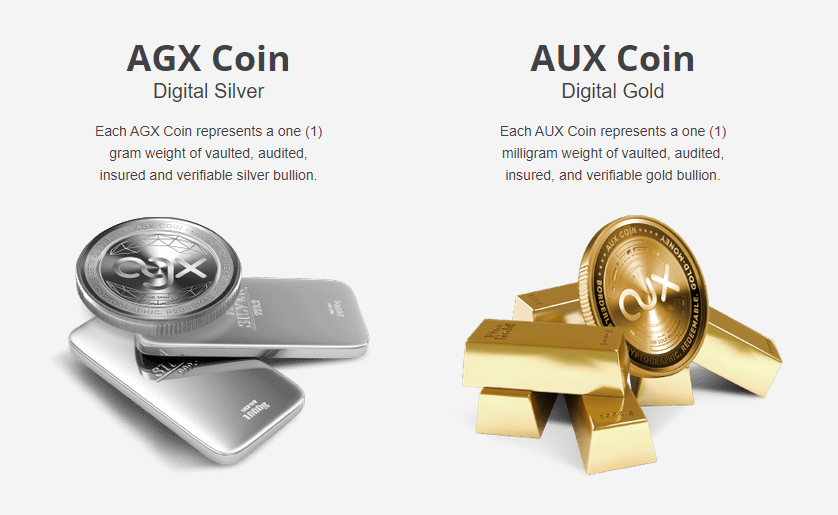

LODE (Switzerland) AG (AGX, AUX)

https://lode.one/

GoldCoin (GLC)

https://www.goldcoin.com/

SilverCoin

SilverCoin.com

Investing in Asset-Backed Digital Currencies

When you invest in asset-backed digital currencies, there are several considerations to keep in mind. Firstly, it’s important to determine your investment budget. Secondly, understanding the conversion costs is crucial. Lastly, being aware of the governance and regulations surrounding these cryptocurrencies is essential. Despite some risks, asset-backed cryptocurrencies offer several advantages, including reliability, transferability, cost efficiency, and international validity.

Investing in asset-backed cryptocurrencies is accessible to anyone with a verified account tied to their crypto exchange of choice.

Remember, it’s always wise to consult with a financial advisor or do your own research before making any investment decisions.

Security and Auditing of Asset-Backed Digital Currencies

When managing gold-backed digital currencies, security and auditing play an essential role. Blockchain security enables transparency during trades. Furthermore, government agencies like the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) regulate and audit these cryptocurrencies.

Want the latest on ABDCs?

Sign up for our newsletter!